Currently, certain games in the Southeast Asian chess and card game market are gaining significant popularity, including QiuQiu, Gaple, Texas Hold'em, and various slot games. The widespread appeal of these games in Southeast Asia offers valuable market insights and serves as a reference for board games aiming to expand internationally. This article will explore how to strategically position our products in the competitive Southeast Asian market and effectively attract players.

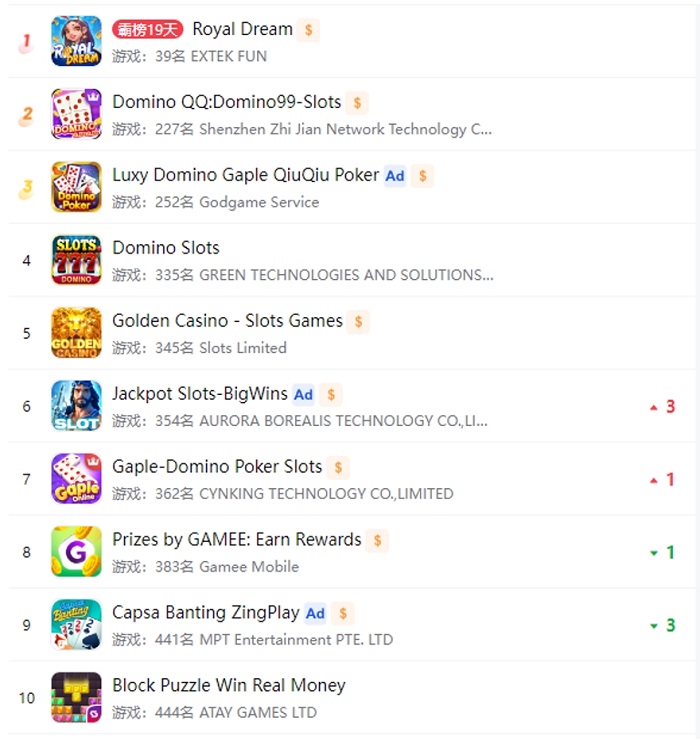

Indonesia Chess and Card Game Ranking

Analyse:

In Indonesia, the chess and card game market is dominated by fast-paced, traditional poker games like Gaple (similar to Domino) and QiuQiu, which align with local cultural preferences. The popular games in this market emphasize player interaction through instant feedback and multiplayer online battles, catering to the tastes of Indonesian players. Most games adopt a free-to-play model to attract users, monetizing through ads and in-app purchases (such as virtual currency and items), which significantly boosts player engagement and prolongs the game's lifespan.

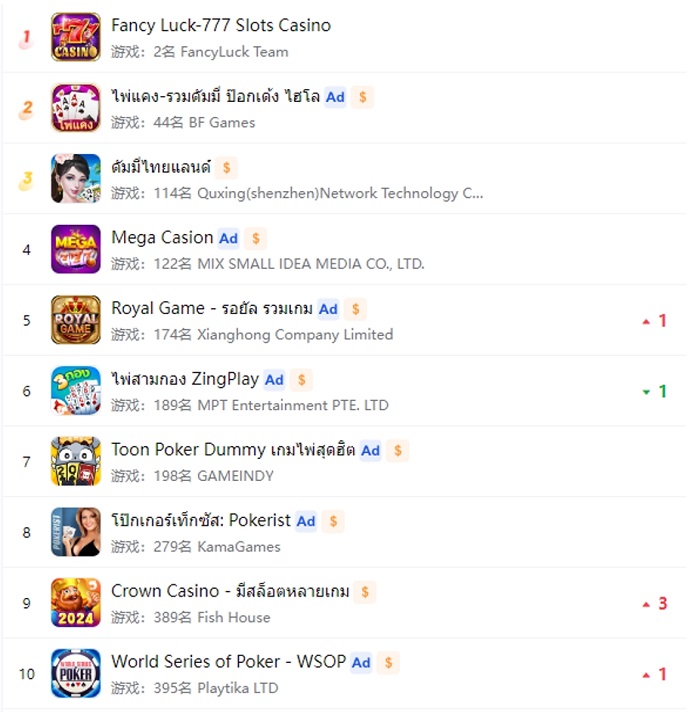

Thailand Chess and Card Game Ranking

Analyse:

The game rankings in the Thai market highlight the popularity of traditional card games, international poker, slots, and more. Among them, Dummy and Kaeng stand out as local games that are particularly favored by Thai players. Additionally, various integrated gaming platforms, such as Royal Game and Mega Casino, provide a wide range of gameplay options to cater to the diverse preferences of players. Most of these games combine ad revenue with in-app purchases, demonstrating the high level of acceptance of ads among Thai players.

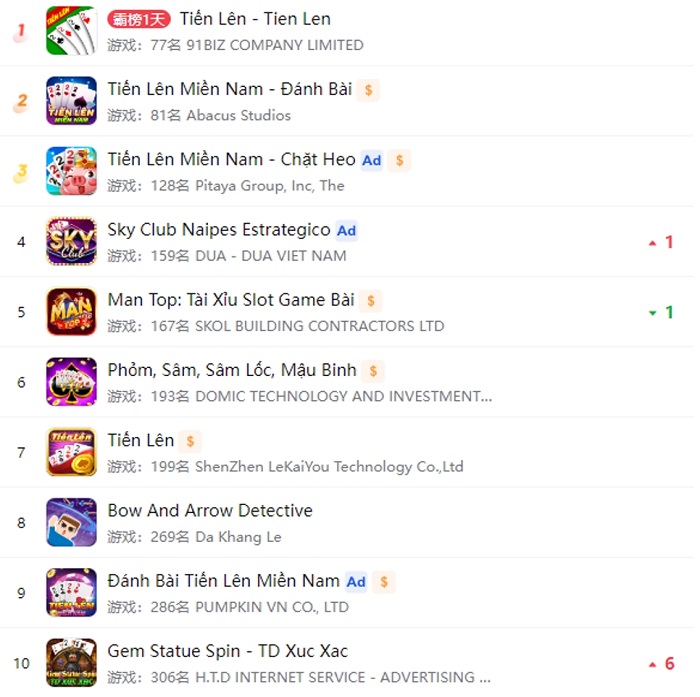

Vietnam Chess and Card Game Rankings

Analyse:

In the Vietnamese market, chess and card games are primarily dominated by Tien Len (Vietnamese poker), with various versions of the game occupying nearly the top half of the leaderboard. In addition to Tien Len, there is a strong demand for slot games and Sic Bo (Tài X?u). Vietnamese players are particularly drawn to casual games that incorporate an element of luck, while games combining puzzle and strategy elements are gaining popularity, signaling a trend toward market diversification. Similar to other regions, business models relying on ads and in-app purchases are widely used in Vietnam.

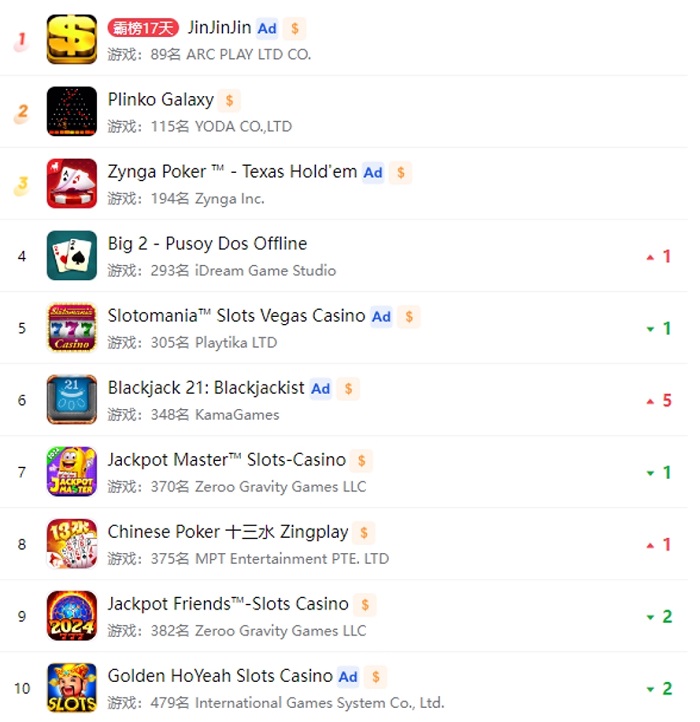

Malaysia Chess and Card Game Ranking

Analyse:

Malaysian players have a strong preference for multiplayer online interactive games, such as Zynga Poker and Blackjack 21, which offer a mix of strategy and competition—elements that are highly valued by the player base. Additionally, localized games like Big 2 - Pusoy Dos and Chinese Poker Thirteen Water hold prominent positions in the rankings, highlighting the popularity of games rooted in local culture. These games enhance user engagement through various monetization strategies, including ads and in-app purchases, which help extend the game's lifecycle.

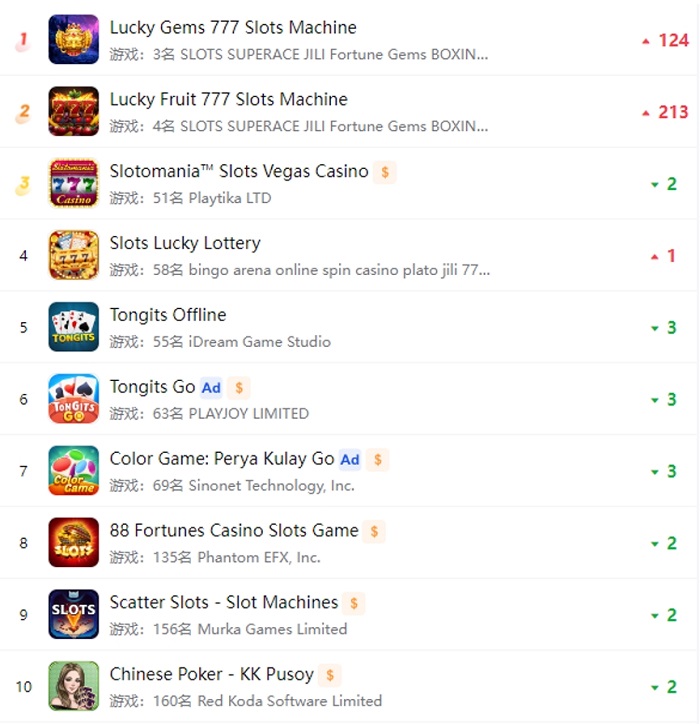

Philippines Chess and Card Game Rankings

Analyse:

In the Philippines, slot games like Lucky Gems 777 and Lucky Fruit 777 are highly popular, particularly for their instant rewards and excitement. Traditional Filipino card games, such as Tongits, also rank well, reflecting players' strong preference for games tied to local culture. Additionally, games with social features, like Tongits Go, enhance the interactive experience for players. The Philippines' gaming business model primarily revolves around advertising and in-app purchases, which significantly boosts profitability.

Singapore Chess and Card Game Rankings

Analyse:

Singapore's gaming market is a blend of Eastern and Western influences, where traditional board games like Mahjong and Thirteen Water coexist with international poker and slot games. Mahjong and MahjongLeh, with their strong oriental roots, are particularly popular, aligning with Singapore's Chinese cultural heritage. Additionally, poker games from India, such as Teen Patti and Rummy, have gained traction, highlighting the country's multicultural influences. Comprehensive gaming platforms like Daifuku Online and Slotomania also attract a large number of casual players, offering a wide range of options for diverse tastes.

Summary

As reflected in the game rankings across Southeast Asian countries, local player preferences are deeply shaped by cultural influences, with traditional board games such as poker, mahjong, and Gaple remaining dominant in many regions. At the same time, the integration of slot games, socially interactive online features, and localized elements plays a crucial role in effectively engaging players. Additionally, the profit model that combines advertising revenue with in-app purchases is widely adopted across these markets, further driving success and player retention.

Contact US

Game Consultant: Aileen

Telegram:@qpgame001

WhatsApp:+62089514312309

E-mail:Aileen@foxuc.cn

Telephone:400-000-7043

Customization | Joint Operations | Consultation: WeChat ID 15099945310 (same as phone number)